Ownership Outearns Traditional Career Compensation

Why equity earns you more in the long-run over chasing money

Hi there! Welcome to another post from our SMB newsletter where we post insightful trends and interesting deals in the SMB space.

If you’re interested in getting these types of emails, hit the subscribe button below. It’s free!

With that said, let’s get into today’s post.

Compensation is, of course, more than money. It includes other aspects such as: how much you enjoy your career, whether it provides fulfillment, how much flexibility you get and how much influence you have over what you do and when you do it.

Owners of small businesses can set their own hours, make their own management decisions, and take pride in the ownership of their work.

I’ve had to personally deal with this conflict as I started off my career in Wall Street chasing money and now I’ve been earning and burning through sweat equity.

The real question that I’m answering in this post is whether or not it’s more lucrative to pursue a traditional career path in investment banking, consulting, or private equity or to put skin in the game and make it that way.

The data is quite surprising so let’s look into the numbers.1

To start, let’s assume that the alternative to being a small firm CEO is to follow a traditional post-MBA career and recognize that, at best, we can only compare expected paths because everyone’s experience will be different.

So, we begin by assuming that the traditional path offers cash compensation equal to the average starting salary. (It might be tempting to turn to the highest starting salary paid, which typically goes to the graduate with the most experience in the most competitive market, who often earns crazy money their first year. But these are rare occurrences, and we believe that using the average yields a more accurate outcome.)

That average is actually hard to nail down, however. Some large sample surveys report that MBAs nationwide have an average starting salary of about $100K. Graduates from so-called elite schools make more, with some estimates of elite school average starting salaries in the $150K range.

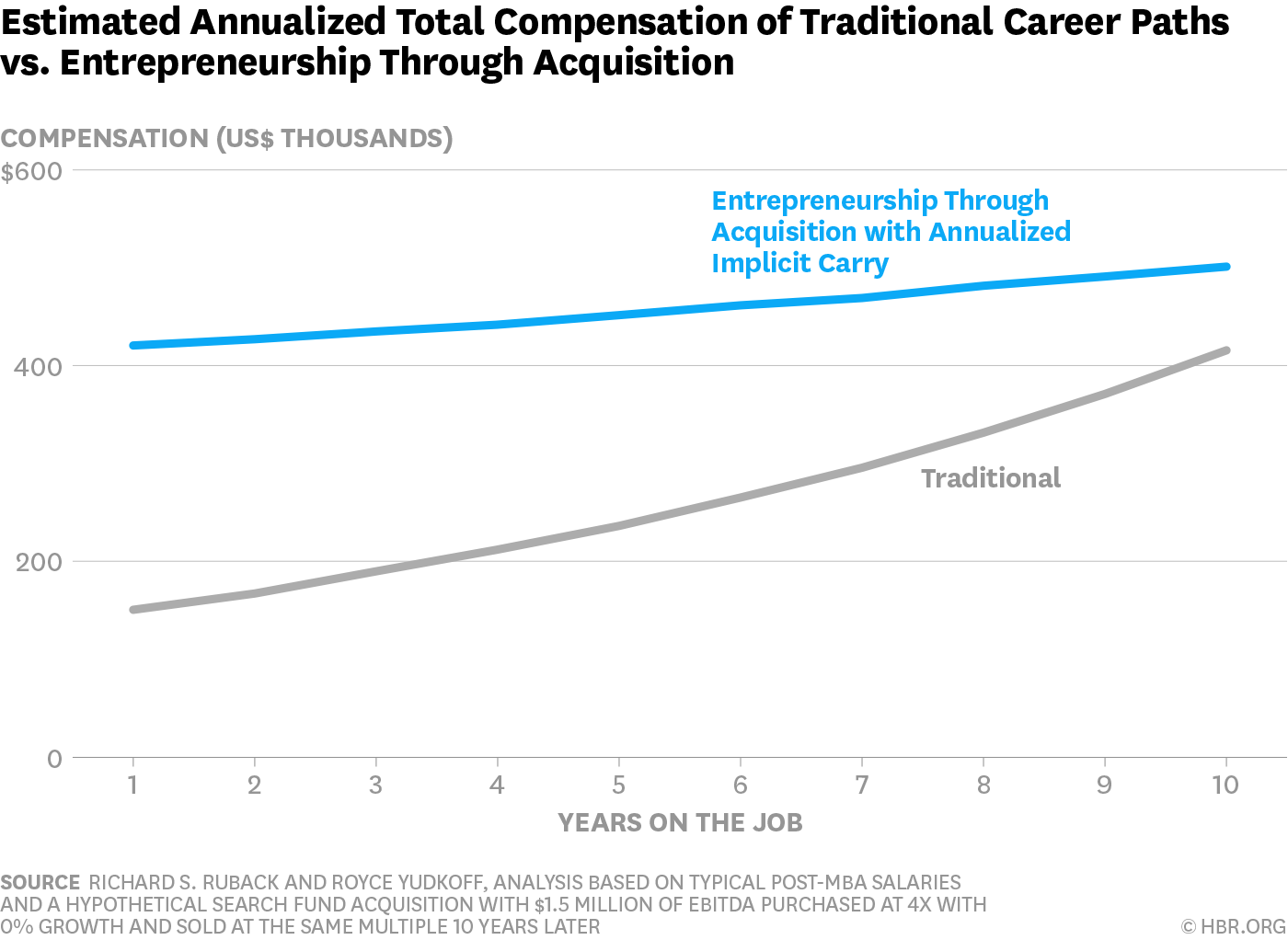

The relative compensation of a traditional career and entrepreneurship through acquisition hinges on salaries in the next 10 years and the carry from deals with investors who provided money to acquire the business. These are of course unknown and highly dependent on the job and the success of the small business itself. But here is a sketch based on the information we have at hand.

We’ll assume the salary in a traditional post-MBA job grows at a 12% compound annual growth rate (CAGR) so that it more than triples in the first 10 years.

We’ll also assume the cash compensation for a new CEO of a small business starts off at the average post-MBA salary, and its growth is generally tied to the performance of the company — both of which are typical.

Harvard Business Review argues that those searching for a small business to buy should target slow-growing dull businesses, so we’ve put this at 5% per year. The chart below shows that over the first 10 years of employment, the cash compensation from the traditional job dominates.

But the annual cash compensation only provides part of the pecuniary payoffs of the purchase of a small business because the entrepreneur also has a significant ownership interest in the company. The size of that ownership interest varies on how they structured their funding throughout the process, but for now let’s assume the entrepreneur has a 20% carried interest in the acquired company. (That means that the CEO keeps 20% of any cash distribution after the investors’ investment is returned and they are paid a preferred dividend.)

The value of that carried interest, of course, depends on the performance of the business, its size, amount of debt used to finance the acquisition and the eventual pricing of a subsequent sale.

To make the analysis tractable, we’ll make some simplifying conservative assumptions: we’ll assume no growth in the business and, because there is no growth, we’ll assume that the selling multiple exactly equals the purchase multiple. We’ll also assume the entrepreneur acquired a $1.5 million EBITDA company for 4x paying $6 million and using 50% debt financing.

To keep things simple, we’ll take advantage of our assumptions of no growth and a constant multiple and ignore the actual timing of the cash flows. That means that, in this example, the purchase price and the eventual selling price will be the same so that the debt and the equity investment can be assumed to be repaid at the sale. This leaves us only with the cash flows that occur between the purchase and the eventual sale.

In this example, the annual cash flow is $1.5 million; the debt is half of the purchase price, or $3 million; and the interest on that debt (assuming a 5% interest rate) is $150,000 annually. This leaves $1,350,000 to be split 80%/20% between the investors and the CEO. The CEO’s implicit annual cash flow from the carried interest is therefore 20% of $1,350,000, or $270,000.

Add this to the cash salary and the entrepreneurship through acquisition path dominates the traditional post-MBA career path, as shown in the chart below.

What happens if we take into account the timing of the cash flows?

The usual timing of cash flows is that the debt gets repaid first, then the equity investors get their investment plus preferred return second, next the entrepreneur gets paid 20% of the preferred return, and lastly, the remaining cash flows are split 80% for the investor and 20% for the CEO.

The bank and investors get paid off before the CEO gets any cash for the carried interest. But the advantage to the traditional path in the early years is very much offset by the impressive EtA cash flows that occur once the carry starts getting paid and even more so upon exit (which we’ve assumed in year 10 in this example). Here is the revised comparison:

Analytical readers may think this is a great opportunity to compute the present values of the two paths, perhaps using different discount rates the reflect the perceived risks of the two paths (the present values are close at 15% for the traditional path and 25% for the EtA path) in hopes of determining which path offers the highest compensation. (HBR recognizes that some believe that the EtA path is riskier and thus would assign a higher discount rate.) We don’t advise that approach.

Instead, we think you should recognize that there are a lot of differences that we haven’t fully modeled. On one side of the coin, there are likely tax advantages from the EtA payouts and increases from growing the acquired business.

On the traditional path side of the coin, there might be pensions or bonuses that we’ve not captured.

Bottom line

There’s a lot more that goes into owning a business aside from just the different types of compensation that you can get from it. This inherently turns many away aside from the obvious that not all can afford a takeover or have the managerial acumen to be an operator.

However, the numbers speak for themselves. If you put in the work, you can really reap the rewards.

If you enjoyed today’s post, please hit the subscribe button below.

Until next time,

Paul Cerro | Cedar Grove Capital

Personal Twitter: @paulcerro

Fund Twitter: @cedargrovecm

HoldCo Twitter: @cedargrovech